The financial services industry is one of the most technologically advanced in the world. Some of the biggest players globally employ ultra-sophisticated technology to help them automate trading, insurance, risk management and more. Key players at several of the largest institutions even see themselves as technology companies – Goldman Sachs’ CEO Lloyd Blankfein, for one.

But even though the financial services industry is embracing tech, it is not deployed evenly throughout. And where there is a gap, there is an opportunity. Channel partners can help solve four important problems that a lot of financial services providers (FSPs) face today: new client onboarding, loans application processing, fraud management and compliance.

New Client Onboarding

Something as fundamental as onboarding new customers shouldn’t be so complicated, but it is. On an outline, it looks straightforward: you collect, validate, and add the new customer’s required documents and personal information to the customer database. But when you implement this process in the real world, complications begin to reveal themselves.

Many FSPs run into a few of the same problems and inefficiencies in their new customer onboarding process. For example, it’s not uncommon for FSPs to collect information from both electronic and paper documents, or pull data from various systems in order to get their customers’ information into their database. This mishmash of paper and electronic information is often stored in decentralized repositories that aren’t accessible across the entire organization, which can lead to more complications in the future.

What appears to be a simple, three-step process is actually much more complicated and prevents FSPs from providing excellent customer service. But these are just hurdles, not impassable barriers.

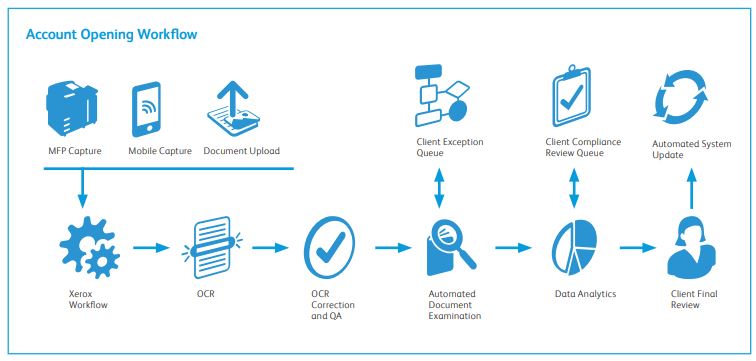

Channel partners can help simplify and shorten an FSP’s onboarding process, reduce mistakes and proliferate customer data across the entire organization by deploying solutions that can automate the most error-prone areas. An example of this is the Xerox Workflow Automation Solution for New Client Onboarding, which automates customer due diligence — capturing information from paper, electronic, and mobile sources, validating them, and then adding the customer’s data and documents to a secure, centralized database.

Ultimately, resellers can use workflow automation technology to increase the processing capacity of their FSP clients so they can take on new business, reduce mistakes with improved consistency, ensure secure storage and retrieval of client content, and increase customer satisfaction.

Loans Application Processing

Loan application processes are typically manual, document-centric processes that have a multitude of steps. For example, to take out a mortgage, borrowers might have to pre-qualify with a lender and then formally apply. Next, lenders review the submitted documentation and provide a loan package for the loan underwriter, who then confirms that the provided information is acceptable (or request more information, if needed). Finally, lenders and borrowers wrap up any loose ends and set a closing date, at which point the funds will be disbursed.

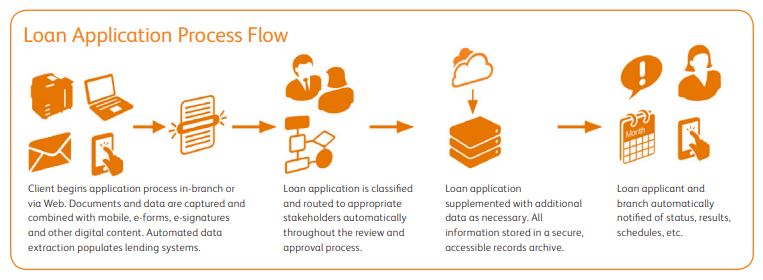

Thankfully, the loan application process also has a high potential for automation with solutions that allow an FSP to collect documents from MFPs, scanners, mobile devices, emails, and critical business systems, classify them, and route them to the loan officer instantly. Workflows can also be configured to automatically notify process stakeholders if any required information is missing, so loan officers and underwriters only get the jobs that are ready to move forward.

FSPs can even use business rules to automate process decisions to keep things moving. Documents are stored in a secure content management repository and can be accessed by authorized users through the banking applications they use in their everyday tasks. One example of this type of solution is the Xerox Workflow Automation Solution for Loan Application Processing.

Automating the loan application process helps FSPs not only reduce costs and save time but also gain greater oversight into their workflows— all while improving customer satisfaction. Not only will a smooth process help them create repeat business, but it’ll also enable them to increase their capacity to take on more customers.

Fraud

When you’re in the financial services industry, it’s not a question of if you’ll have to deal with fraud — it’s when. And as a result, FSPs spend a good deal of time and resources to help prevent and investigate fraud.

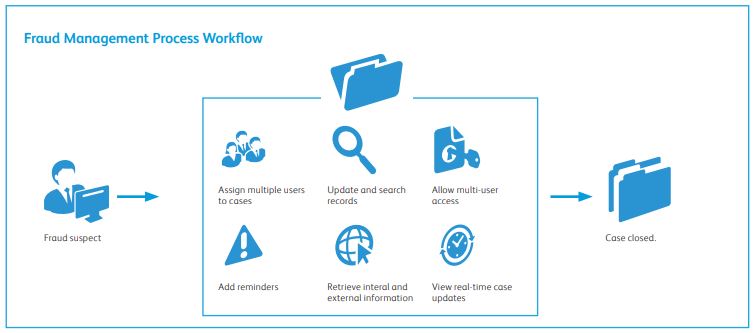

In fraud investigations, investigators typically have to pull data from multiple applications and compile them into various spreadsheets. Usually, only a single investigator can access one file at a time, which can prevent others from taking action. It’s also not uncommon to encounter situations where investigators will be working with multiple, differing versions of the same document, which can create confusion.

The Workflow Automation Solution for Fraud Information Management is one way to take the chaos out of fraud investigations. The solution provides investigators with an easy way to create, assign, search for, update, and link cases in a single platform. Instead of jumping between spreadsheets and applications, multiple investigators can easily compile all the important information they need, even if someone else is already viewing it.

By streamlining and improving their access to critical information, resellers can help the FSP investigators complete investigations faster.

Compliance

Today it seems like banks have to deal with more regulations and oversight than ever before. Financial institutions have to navigate long and complicated policies, procedures, and reporting mechanisms in order to stay compliant with the law. Often, audits can pull customer-facing staff members away from their core tasks, and make it harder for financial institutions to provide excellent customer service. The end result: higher costs, slower processes, and a C-suite that can’t sleep because they’re worried about penalties and fees.

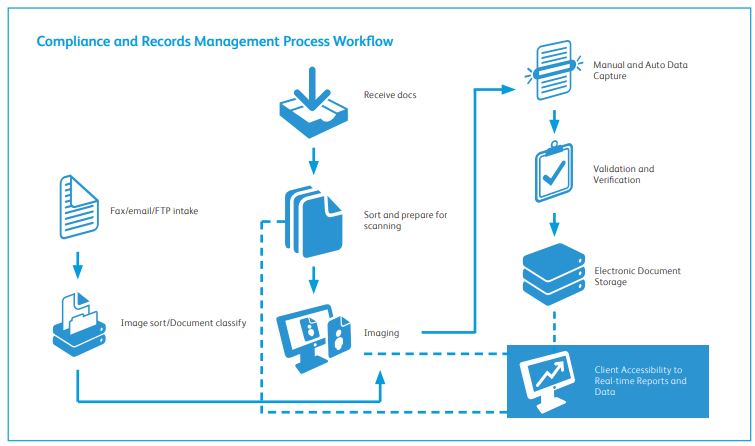

Luckily, the solutions mentioned earlier all come with their own security components built-in — namely, the ability to maintain an audit trail of every document and action taken in a workflow, and the ability to automate document retention policies. Additional tools that can compile all the data into a secure, centralized repository, so anyone with permission can easily search for and access the information they need in a single platform will make these tasks secure and compliant.

The Xerox Workflow Automation Solution for Compliance and Records Management is one tool that accomplishes this goal, helping FSPs consolidate and index all their documents into one secure platform.

Ultimately, the more manual, paper-reliant processes your FSP customers have, the more opportunity you have to swoop in and look like a hero. You’re not just showing them where you can use automation to simplify and shorten processes–you’re showing them how to provide excellent, speedy customer service, increasing their capacity to take on more new business and grow their organization, protecting their most sensitive of information, and keeping them compliant with the hundreds of regulations.

Once they see just how efficient you can make their business, you’ll have a partner for life.

Become a Xerox Channel Partner

Become a Xerox Channel Partner

Ready to become a Xerox Channel Partner? Contact your Xerox account manager or review the Xerox Global Partner Program and apply to become a Xerox channel partner today to find out how we will help grow your business.

Join our Xerox Channel Partners LinkedIn Community

Looking for more marketing tips and insights from Xerox Agents, Concessionaires, and Document Technology partners from across the globe? Join our private Xerox Channel Partners LinkedIn Group.

Share this on Twitter!

Tweet: Four important problems that a lot of financial services providers face today and how you can help: https://ctt.ec/tb65w+ via @XeroxPartners

Subscribe to the Channel Partner Connection and receive email updates when we publish a new article.[wysija_form id=”1″]